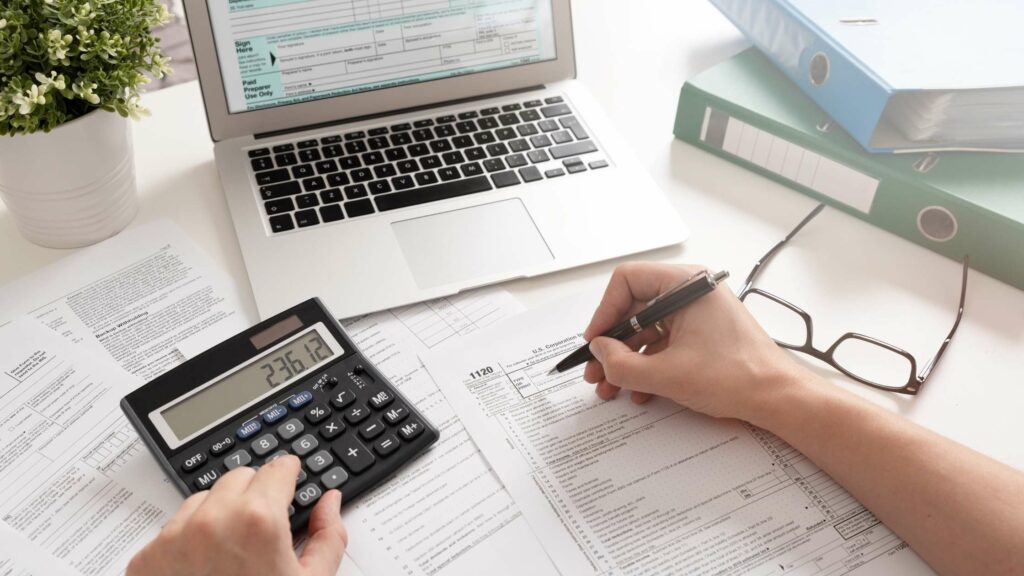

Businesses opt to offshore various operations to save costs and scale their expansion. Offshoring finance is one such business operation that has seen rapid growth in recent years.

By offshoring finance activities, companies can:

- Meet regulatory requirements.

- Conduct complex finance reviews and tax preparation.

- Diversify investment portfolios and more.

But how do you offshore your finance operations?

In this article, we’ll explore what offshore finance means, along with its pros and cons. We’ll also look at simple tips to offshore successfully.

Table of Contents

- What does offshoring finance mean?

- What are Offshore Financial Centers (OFCs)?

- 3 key ways of offshoring finance functions

- 3 important advantages of offshoring finance tasks

- 3 major limitations of offshoring finance functions

- 3 simple tips for offshoring finance functions successfully

Let’s get started.

What does offshoring finance mean?

Offshoring refers to a company hiring a third-party service provider in a different location to handle its business operations. This includes Business Process Outsourcing (BPO), Information Technology (IT services), automation, etc.

Offshoring finance refers to when a company specifically offshores financial services to third-party providers overseas. These services include tax compliance, wealth management, financial decision support, etc.

Businesses may offshore finance to an overseas location for several reasons, including:

- Favorable economic conditions.

- Increased tax savings.

- Relaxed business regulations.

- Better asset protection, and more.

But how do companies narrow down on where to offshore finance?

This is where Offshore Financial Centers (OFCs) come into the picture.

What are Offshore Financial Centers (OFCs)?

Offshore Financial Centers (OFCs) are popular overseas regions where businesses set up corporations, investments, and deposits.

The term is usually used in the banking and financial sectors to describe overseas locations where business regulations are different from a company’s home country.

Companies and individuals offshore their financial activities to popular OFCs to access favorable economic conditions.

Popular OFCs include countries like the Cayman Islands, Bermuda, Costa Rica, British Virgin Islands, Switzerland, Ireland, Hong Kong, United Kingdom, Singapore, and Malaysia.

While the level of business regulatory standards and transparency differs among OFCs, they generally offer:

- Favorable tax laws that make them popular tax havens for businesses.

- Significant cost savings on business operations.

- Better protection of assets and intellectual property.

- Flexible business regulations, including data security, privacy measures, and more.

Let’s get a better understanding of offshore terminology with insights into the three types of offshoring finance.

3 key ways of offshoring finance functions

Here’s a closer look at the three key types of offshoring finance.

1. Offshoring financial services

Offshoring financial services refer to outsourcing financial business activities to third-party service providers in a different location. This includes outsourcing non-core competencies like accounting, project financing support, regulatory activities, tax compliance, and more.

Offshoring financial services can allow companies to take advantage of favorable economic conditions, such as lower wage requirements and flexible labor regulations.

2. Offshore investing

Offshore investing involves a situation in which investors residing outside the offshore nation invest in the nation’s businesses. This practice is particularly common with high-net-worth investors looking to expand their business in a different country.

Offshore investing often requires opening offshore accounts in the overseas country in which the business wishes to invest.

Some of the key advantages of holding offshore investment accounts include tax benefits, arbitrage trading, business confidentiality, and asset protection.

Offshore accounts are usually opened in the name of a corporation, such as a limited liability company (LLC) or a holding company. This practice opens up business investments to more favorable tax treatment.

3. Offshore banking

Offshore banking involves safeguarding a company’s or an individual’s assets in financial institutions in foreign countries.

Like offshore investing, this practice allows businesses to access favorable business regulations otherwise unavailable in their home countries.

Individuals and companies can use offshore bank accounts to access business funds in the required currency without keeping tabs on the changing exchange rates.

On some occasions, companies with significant sales overseas may open bank accounts to keep related profits in countries with lower tax burdens. On other occasions, businesses use offshore banking to safeguard their assets from authorities in their home countries.

With this offshoring finance terminology in mind, let’s look at the key advantages of offshore finance.

3 important advantages of offshoring finance tasks

Here are three important advantages that businesses engaging in offshoring finance enjoy:

1. Tax advantages

Certain countries offer tax incentives to foreign businesses and investors. The favorable tax regimes in these countries are designed to promote a healthy investment ecosystem that attracts outside interest and wealth.

A country of this nature is usually referred to as a tax haven.

Most tax havens are smaller countries with limited resources and workforce constraints. Attracting outside investors helps these countries boost their economic activity exponentially.

Note that offshore investments only occur when offshore investors form a corporation in an overseas country. This corporation then shields an investor’s offshore accounts from higher tax burdens in their home country.

Additionally, because these corporations don’t engage in local operations, little or no tax is imposed on them in the offshore country.

An example would be the Bahamas, which doesn’t impose any income tax, corporate tax, value-added tax, or wealth tax on offshore companies.

2. Asset protection

Offshoring finance can also help businesses restructure the ownership of their assets. This process of transferring individual wealth ownership is made possible by forming trusts, hedge funds, or an existing corporation.

This form of asset protection can help companies:

- Decrease the risk of being targeted by a lawsuit.

- Secure assets in situations excluded by insurance coverage.

- Minimize loss for small businesses likely to be sued by lenders.

- Get ample time to decide how to use assets efficiently.

- Minimize business conflicts within joint business ventures.

For instance, in Belize, the government aids risk management by protecting your assets. Your assets remain protected even if another country’s government requests access to your accounts or tries to seize assets.

3. Diversification of investment

Most financial experts preach by the idiom, “Don’t place all your eggs in one basket.” Concentrating wealth in one location is a risky affair.

One of the biggest risks of concentrating wealth in one location is currency deflation. Currency deflation or the fall in a country’s currency can lead to the subsequent fall of the currency’s purchasing power.

Offshore investing, such as tax equity investment, is one of the best ways to avoid such scenarios and diversify your assets.

Diversification spreads your investments and your holdings across multiple offshore jurisdictions. The process also lessens your chances of getting caught up in a country’s economic downturn.

Now that we’ve looked at the advantages of offshoring finance, let’s learn about the disadvantages.

3 major limitations of offshoring finance functions

Here are the three major cons of offshoring finance services:

1. Increased regulatory scrutiny

The key downside to offshoring finance is the regulatory scrutiny an offshore jurisdiction faces from foreign governments and tax authorities.

Previous money laundering and tax scandals have only increased the scrutiny on offshore projects and investors offshoring to these destinations.

Past tax fraud scandals include:

- Panama Papers (2016): Over 11 million secret documents from Mossack Fonseca, an offshore law firm in Panama, revealed how multinational companies, CEOs, and other individuals were exploiting offshore tax regimes.

- Paradise Papers (2017): Over 13.4 million leaked documents from Appleby, an offshore law firm in Bermuda, revealed illegal offshore activities like money laundering.

- Pandora Papers (2021): Over 12 million leaked documents revealed how leaders from over 90 countries exploited tax sheltering schemes.

These scandals have prompted governments worldwide to modify their policies and create more stringent tax laws.

For instance, the United States government has enacted laws like the United States Foreign Account Tax Compliance Act (FATCA) in 2010 that requires American citizens at home and overseas to file annual reports on their foreign account holdings.

The United States Internal Revenue Service (IRS) also taxes citizens on their worldwide income. As a result, offshore investors who use offshore entities to evade income tax on foreign capital gains are prosecuted for tax evasion.

Similar to North America, jurisdictions in Latin America also have laws like General Anti-avoidance Rules (GAAR) to prevent tax loopholes.

Apart from dealing with offshore policies ethically, it’s best for companies to first understand the legal and tax implications of an offshore destination.

2. Potential geopolitical unrest

Companies offshoring to prominent outsourcing countries may have to deal with the unstable political climate. This can cause several geopolitical risks for businesses.

Geopolitical unrest can be caused by issues such as a government shutdown, riots over an election, a military coup, etc.

For instance, Ukraine is a popular offshore outsourcing location in Europe but is frequently exposed to political unrest that can flare up anytime without warning. This is more common with developing countries that are generally the go-to destinations for offshoring than developed countries.

While picking an offshore location, it’s advisable to look at the economic and political history as well as current affairs before making a move.

3. Management challenges

Unlike in-house, onshore, or nearshore teams, offshore teams are outside a company’s home country. This means businesses offshoring services can face day-to-day management challenges.

These productivity-hampering issues can be related to communication gaps, cultural barriers, time zone differences, and more.

Other consequences of offshoring financial services to different locations can include:

- Quality concerns: Since location working conditions and regulations can differ from your home country, offshoring can result in low-quality work output.

- Delayed deliverables: An offshore employee or a service provider can have different working styles from your company. This can cause an inevitable delay in achieving targets.

- Employee performance issues: Managers may face hurdles while assessing the productivity of an offshore team.

An offshore company should ideally prepare for these workforce management challenges ahead of time. And the simplest way to do this is to leverage the right time tracking and productivity software.

Wondering how you can avoid these offshoring challenges?

Read on to find out.

3 simple tips for offshoring finance functions successfully

Here are three easy-to-execute tips to help you offshore finance tasks successfully:

1. Set realistic targets

Offshoring can present many inevitable challenges with team collaboration, lack of transparency, and hidden pricing.

For instance, even though offshore accounts help with cost savings, setting them up can increase your investment costs.

When businesses don’t account for these hurdles, they may be disappointed by their offshoring

experience. That’s why it’s important to set realistic expectations from the offshore service provider, especially at the start of your partnership.

Additionally, companies must focus on performance-based compensation for offshore staff to get value from offshore operations before the financial close.

2. Understand legal and tax implications

Legal and tax implications and compliance issues can change drastically depending on the offshore destination you choose. That’s why it’s always a good idea to consult with an experienced and reputable team beforehand.

This team can consist of investment advisors, accountants, and lawyers who specialize in offshore finance.

For instance, if you’re looking to offshore your investments to help protect your company’s assets, it’s crucial that you consult with an attorney (or a team of attorneys) specializing in asset protection, business succession, or wills.

Note that hiring these professionals can lower cost savings. But when done right, the benefits of offshore financing can outweigh the high costs of professional fees, commissions, and travel expenses.

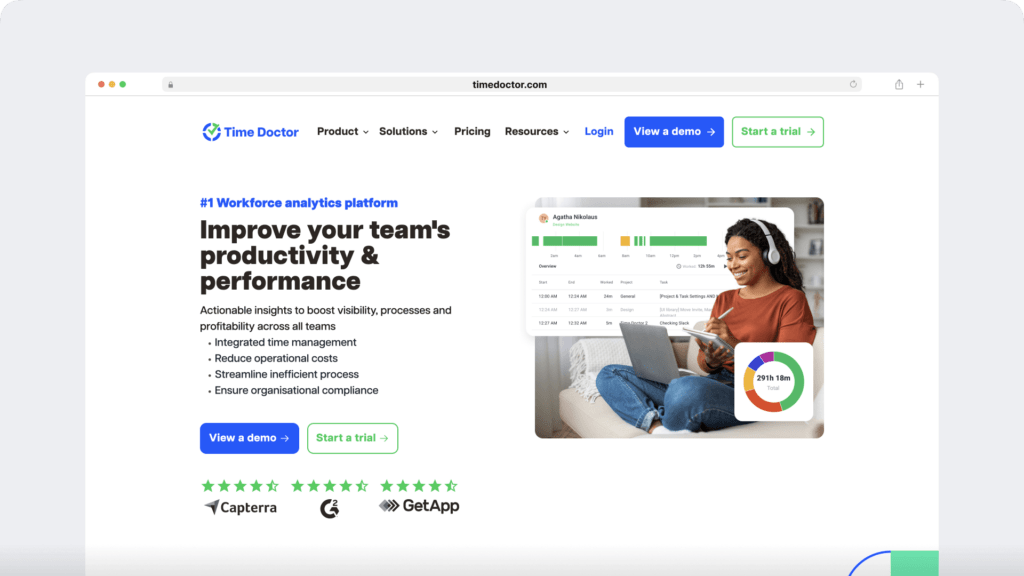

3. Use time tracking and productivity software

Monitoring your offshore team’s performance is near impossible without the right technology. The right time management and productivity tool can help you collaborate with the offshore team and ensure they’re working in line with your financial goals.

One such productivity and time management tool is Time Doctor.

Large companies like Ericsson, and small businesses like Thrive Market, use Time Doctor to keep track of their employees’ productivity during work hours.

Here’s how this powerful employee productivity tool can help you overcome several remote team challenges:

- Track all working hour metrics with an easy-to-use timer.

- Get detailed productivity reports on each offshore employee.

- Plan and maintain a log of their shifts and schedules.

- Integrate your payroll with Time Doctor.

- Use the Android mobile app to monitor your offshore teams on the go.

For more information, explore the complete list of Time Doctor’s features and benefits.

Final thoughts

Offshoring finance can be beneficial for your company. You can choose to outsource a financial service or engage in offshore banking or investment, depending on your business needs.

When done right, offshoring finance can lead to business profitability, business expansion, asset protection, and financial stability.

However, there are several things you need to consider before hiring an offshore service provider and choosing an offshore destination.

Go through the pros, cons, and tips mentioned in this article to decide whether offshoring finance is the right move for your business.

Andy is a technology & marketing leader who has delivered award-winning and world-first experiences.