Timekeeping has become a critical business process for many companies today.

Maintaining detailed employee timesheets offer tremendous benefits ranging across industries and business functions.

However, employers often face confusion and uncertainty when it comes to using timesheets for exempt employees. According to the US Department of Labor, these are salaried professionals who aren’t eligible for minimum wage or overtime pay.

In this article, we’ll share six solid reasons to use timesheets for exempt employees, along with five best practices and three tools to streamline the process.

This article contains:

(click on the links below to go to a specific section)

- 6 Major Reasons to Maintain Timesheets for Exempt Employees

- 5 Best Practices For Managing Timesheets for Exempt Employees

- 3 Best Timesheet Software for 2021

Let’s get started.

6 major reasons to maintain timesheets for exempt employees

In the USA, the Department of Labor (DOL) mandates that employers classify jobs into two categories — exempt and nonexempt.

The Fair Labor Standards Act (FLSA) is a federal law that establishes a clear set of rules for each category based on:

- How the employees receive the payments.

- How much they earn.

- The type of duties they perform at the job.

Let’s first take a look at the FLSA requirements to be an exempt employee and non-exempt employee.

A. Who is an exempt employee?

Employees are considered exempt from FLSA coverage if they meet the following tests:

- Salary basis test: Must be paid a minimum guaranteed amount (base salary), which can’t change with the quantity or quality of work.

- Salary level test: The guaranteed salary should be above a minimum threshold (as per state and federal law).

- Duties test: Must perform job duties considered exempt by FLSA, such as executive, administrative, or professional duties.

B. Who is a non-exempt employee?

A non exempt employee is usually an hourly employee who receives payment based on a fixed hourly rate. The nonexempt workforce includes freelancers, interns, temporary employees, etc.

The Fair Labor Standards Act (FLSA) covers non-exempt workers with benefits such as:

- Minimum wage: The minimum remuneration per hour that an employer must pay an hourly wage worker. In 2021, the lowest minimum wage in the USA is about $7.25.

- Overtime pay: Additional compensation for working over forty hours in a workweek. Overtime wages should be at least one-half the regular rates of pay.

To protect them from underpaid or unpaid wages, FLSA requires employers to maintain detailed time records for every non exempt employee.

Although there’s no such rule for salaried employees, there are solid reasons why you should still track time for exempt employees.

Let’s explore them in detail:

1. Accurate billing and invoicing

Many businesses, especially service-based companies, usually charge their clients by total billable hours.

Billable hours refer to the time your employees spend working on tasks directly related to the project.

To accurately measure billable hours, you’ll need detailed time logs that record how your employees spend their working hours. This will help you separate billable (project research & planning, client communication, etc.) and non-billable tasks (training, networking, etc.).

Differentiating between billable and non-billable tasks will help you generate detailed and accurate invoices at the end of the project cycle or after service sessions.

Moreover, having detailed timesheet data boosts your business credibility and protects you in case of legal disputes.

2. Accurate payroll records

Exempt workers often report to more than one department within an organization. In such cases, their final salary may come from separate internal budgets.

Tracking their work time helps the company monitor how much time they have spent working for different departments.

At the end of each pay period, the payroll department can collate the time data and determine each department’s contribution towards the final salary.

Another benefit of having detailed timesheets is that the company can ask the employees to review and verify their time logs before salary processing. It will help prevent salary miscalculations and missed payroll deadlines.

3. Track paid time-offs

A salaried employee is usually eligible for paid time offs (PTO) — a fixed pool of hours or leaves that includes sick leave, maternity or paternity leave and paid vacations.

Every time an employee avails of PTO, it gets deducted from their monthly or yearly quota.

Now, it’s in the best interest of both the employer and the employee to keep track of PTOs.

For employers, it makes PTO management fast, accurate and convenient. At the same time, employees can use it to stay updated on their available quota. Besides, actively tracking off-hours and leaves through timesheets make the process transparent for the stakeholders.

Fortunately, most electronic timesheet software offers a built-in PTO tracking feature to manage paid time-offs accurately.

4. Calculate overtime compensation

As per FLSA rules in 2021, exempt employees with salaries less than a minimum threshold are eligible for overtime pay (for working over 40 hours in a work week ).

Besides, many companies offer overtime pay, time off in lieu, and other rewards to a salaried worker for putting in extra hours.

To effectively calculate such compensations, companies should actively track their employees’ time. Most time-tracking software can effectively track overtime hours for both an hourly and salaried worker in your company.

5. Efficient project management

Accurate timesheet data can significantly improve the way you manage your projects, right from conception to completion.

How?

Here are few ways timekeeping can help a business owner or project manager:

- Helps you prepare an estimated timeline for a project by analyzing time usage reports for similar projects in the past.

- Forecast workforce requirements based on the above timeline.

- Track what each team member is working on and distribute work accordingly.

- Monitor how efficiently your team members are performing their assigned job duties.

- Compare your current progress with the estimated timeline.

- Use your human resources effectively.

To simplify things further, you can use advanced timesheet software, such as Time Doctor, that also offers project management features.

6. Promotes accountability

Recording daily work activities help employees stay accountable for their output and productivity.

A thorough timekeeping regimen will encourage your employees to optimize their work and stay focused on the task at hand. Additionally, employees are less likely to procrastinate, knowing that a supervisor can evaluate their productivity at any given time.

However, keep in mind that an employee’s timesheet alone won’t help you gain insights into their performance.

Now that you know why timesheets are important for exempt employees, let’s check out how you can go about the process.

5 best practices for managing timesheets for exempt employees

Here are some golden rules to make timesheet management more efficient and quick:

1. Communicate why time tracking is important

Since an exempt employee’s salary doesn’t depend on the number of hours they put in, they may feel a little apprehensive about tracking their work hours.

Companies should make it a priority to educate their employees on why time tracking is essential. Tell them how it not only helps with business functions but also improves employee productivity and performance.

It’s a good practice to address common questions that employees might have about timekeeping, such as:

- What happens if I log less than eight hours a day?

- What role does time data play in promotions and appraisals?

Having a transparent policy on timekeeping will help you gain your employees’ trust and keep their morale high.

2. Keep it consistent

Asking only a section of your employees to track their work hours will lead to confusion and employee dissatisfaction.

You should make it a point to ask all your employees to track their time and also keep the policies uniform across the company.

Moreover, when you have company-wide time data, you get deeper insights into employee productivity. You’ll be able to understand why some employees consistently perform better than others.

You can use these insights to make impactful changes to the workflow and reinforce your training program.

3. Incentivize timekeeping

A great way to encourage salaried employees to track their work hours is by incentivizing the task.

You can create reward programs for employees who diligently fill their timesheets rather than penalizing those who don’t. For example, you can offer gift cards or bonuses to employees who submit their timesheets the quickest or to the ones whose data is the most accurate.

4. Make it hassle-free

Making the timekeeping process quick and easy will ensure that employees come on board with conviction.

You could use technology that merges timekeeping with the employee workflow making it more intuitive and fast.

For example, you can use biometric scanning that automatically populates the timesheets instead of asking your employees to fill them manually.

Alternatively, you could use a convenient time clock software that starts tracking with just a few mouse clicks. Besides, these tools also remind the users when they forget to log their time.

But even with all the technological support, timekeeping can still feel like a chore at times.

Fortunately, some time-tracking software can gamify timekeeping tasks, making them fun for the employees. Not only does it boost productivity, but it’s also a great way to identify your top-performing employees.

5. Keep separate records

It’s a good practice for companies to keep timekeeping for exempt and nonexempt employees separate.

Why?

FLSA protects nonexempt employees with strict time-tracking regulations. As a result, their timekeeping requirements differ from salaried employees.

For example, nonexempt employees have a fixed hourly rate, and the goal is to accurately track their work time in hours to determine their daily wage. FLSA also mandates that break times under twenty minutes must be counted as paid work time. So an employee need not punch out before taking these breaks.

Such rules do not apply to timekeeping for exempt employees. The focus is not on how many hours they work for but on how well they use their work hours.

In many cases, the company may not need hourly data but just the total number of work days during a pay period. It’ll help calculate any deductions for leaves that employees take over the PTO.

Since hourly tracking of the employees’ time drains many resources, it makes sense to use it only for your non-exempt workforce.

3 best timesheet software for 2021

If you’re looking for timesheet software for exempt employees, here are our top three picks:

1. Time Doctor

Time Doctor is a robust employee time management tool used by large organizations as well as by startups and small businesses.

It offers powerful time tracking and timesheet management features for both salaried and hourly employees.

With Time Doctor, employees can conveniently track their work hours and stay focused on work, while managers can monitor their productivity through real-time reports.

A. Key features

Let’s check out Time Doctor’s features in detail:

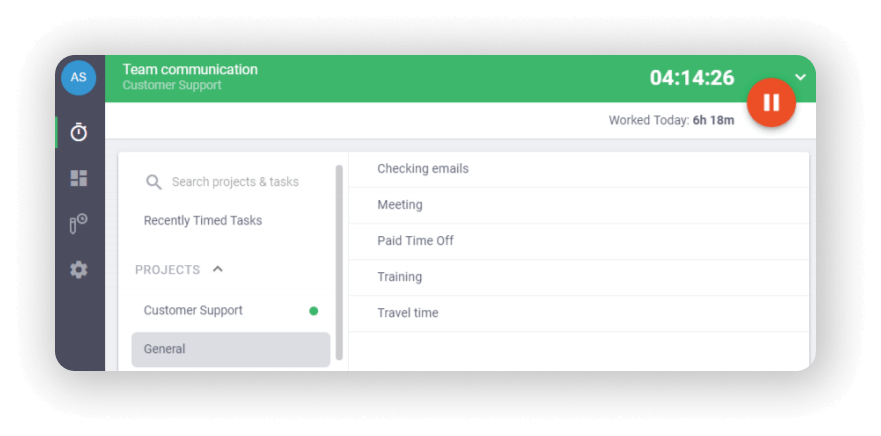

a. Interactive time tracking

Time Doctor simplifies time tracking with a convenient timer. All your employees need to do is enter the task name and hit start.

It’ll continue tracking time in the background till the employee hits stop.

To make things easier, Time Doctor also offers an automatic time tracking feature that tracks time when employees turn on their computers. This way, they won’t forget to manually turn on the timer.

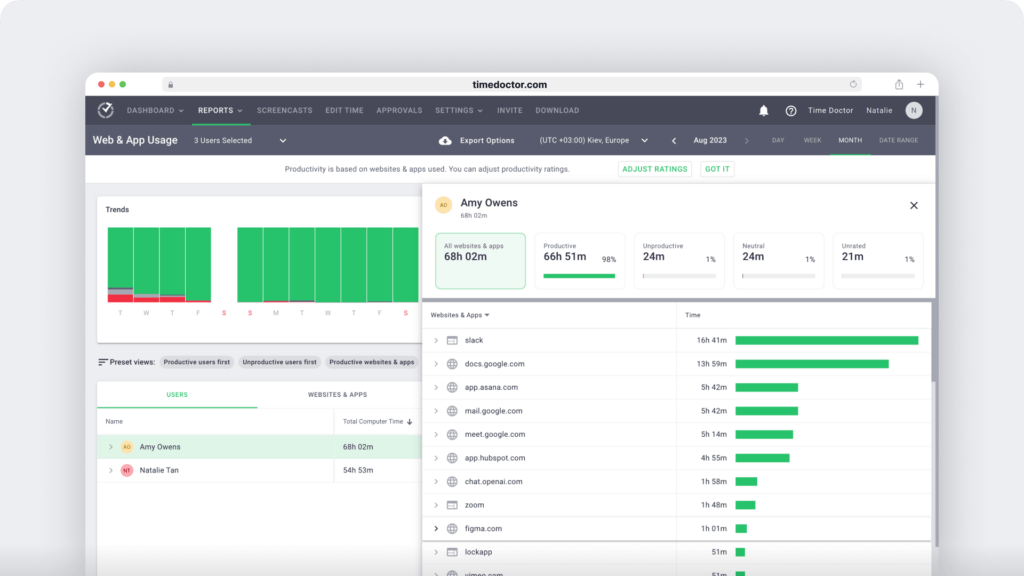

b. Comprehensive reports

Time Doctor generates real-time reports based on the time tracking data to help you assess your team’s productivity.

Some of these reports include:

- Timeline report: Get an overview of how your employees spend their work hours through a detailed time log.

- Hours tracked report: Monitor how many hours your employees have tracked time each day, week, etc.

- Projects and tasks report: Measure the time your employees take to complete projects and individual tasks.

- Activity summary report: Check employee activity during a specific time duration.

- Web and app report: Track the amount of time employees spend on different applications and websites.

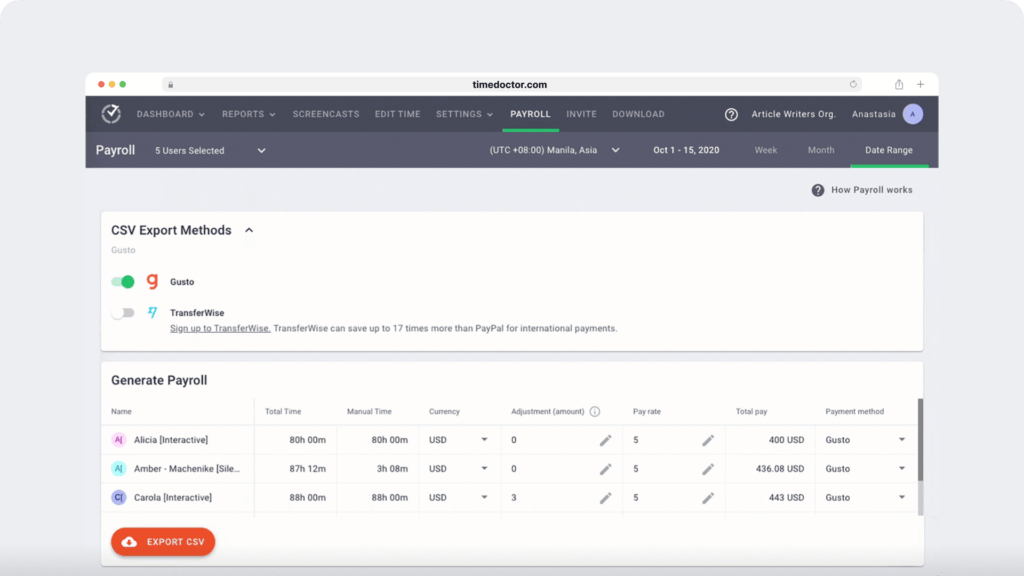

c. Integrated payroll management

With Time Doctor’s integrated payroll management system, you can pay your salaried and hourly employees quickly and accurately.

It can automate timesheet processing to help you make bulk payments much faster. You can also customize your payroll with different pay periods, currencies, and more.

d. Powerful integrations

Time Doctor’s Chrome extension helps you combine its powerful features with popular business tools such as Jira, Asana, GitHub, and more.

The integration will add a ‘start’ and ‘stop’ button to any tool you pick. The extension syncs the tasks and time data with the desktop app, — you won’t have to switch across multiple apps anymore.

B. Pricing

Time Doctor’s pricing plans start as low as $7/month per user. You can also sign up for a free 14-day trial without any credit card information.

C. Customer ratings

- G2: 4.3/5 (150+ reviews)

- Capterra: 4.5/5 (300+ reviews)

2. QuickBooks Time

QuickBooks Time is an easy-to-use time tracking software that offers a quicker alternative to a manual timecard system. It can help you monitor your team’s productivity using a web-based or mobile application.

A. Key features

- Use a GPS-enabled timesheet tracker to manage employee productivity.

- Update employee schedules on the fly and sync them with timesheets.

- Set up customized alerts to remind employees to track and submit time.

- Export payroll reports in CSV, Excel, or PDF formats.

B. Pricing

Paid plans start from $8/month per user with a monthly base fee of $20.

C. Customer ratings

- G2: 4.5/ 5 (1300+ reviews)

- Capterra: 4.7/5 (5000+ reviews)

3. ClickTime

ClickTime is an electronic timesheet solution that helps track, plan, and manage employee productivity.

A. Key features

- Built-in time-off calendar to track your team’s vacation schedule.

- Expense and resource planning features to help improve project performance.

- Overtime analysis dashboard to manage employee overtime hours.

- Automate sick leave approvals and accruals.

B. Pricing

Pricing plans start at $9/month per user.

C. Customer ratings

- G2: 4.4/5 (150+ reviews)

- Capterra: 4.6/5 (100+ reviews)

Wrapping up

Tracking your exempt employees’ hours and keeping accurate records have multiple benefits for business owners. It’ll help you maximize team productivity while staying compliant with timekeeping and recordkeeping regulations.

Use the tips and tools shared in this article to develop a solid company-wide timekeeping system.

For instance, tools like Time Doctor help you simplify the process by combining timesheets and project management into one powerful platform.

So why not sign up for Time Doctor’s free 14-day trial and get started today?

Andy is a technology & marketing leader who has delivered award-winning and world-first experiences.