If you’re searching for the most efficient way to wire transfer money overseas, you’ve probably heard of Wise (formerly TransferWise). Wise is one of the many money transfer companies that work to provide you with honest, fair, and efficient international payment services.

To help you decide if Wise is the company for you, our in-depth TransferWise review will present all the ins and outs of using this money transfer service. We’ll cover how it works, some frequently asked questions, its pros and cons, and do a competitor analysis.

Note: Time Doctor has a simple and accurate way for you to process your company’s payroll using Wise (formerly TransferWise). Time Doctor creates verified timesheets that you can download in CSV format and upload directly to Wise to complete your payroll. Try it for free for 14 days.

Let’s get started.

The background of Wise (Formerly TransferWise)

Wise was founded in London in 2011 by two financial gurus, Taavet Hinrikus and Kristo Kaarmann, who both have impressive financial and business backgrounds.

The investors that back Wise are equally impressive and include IA Ventures, Index Ventures, Seedcamp, Kima Ventures, Virgin Group’s Sir Richard Branson, and PayPal founder Max Levchin.

Since its inception, Wise has had seven funding runs totaling over USD 396 million. Their team includes over 23 bright employees, five board members, and Wise continues to grow.

With over 157,600+ TransferWise reviews on Trustpilot, it’s clearly a popular international money transfer service.

So how simple is it to transfer money with Wise? Let’s see how Wise works to find out.

How does Wise (Formerly TransferWise) work?

To begin using Wise, you need to create a Wise account. Then, you can send and receive money internationally.

Once Wise receives an international money transfer request, they exchange currencies in a transparent way, meaning you can always refer to their website to see exactly what the exchange rates are.

If you are worried about the exchange rates when sending money to another country, Wise also links the currency rates posted on XE, Google, and Yahoo right on their website for your reference. That way, you can check and compare multiple currency rates whenever you want.

Once the currency has been exchanged, Wise then makes a local transfer to the person you wired the money to on the other side.

Wise saves you money by taking a small percentage of the transaction rather than having you pay a credit card transaction fee or a bank transfer fee. Bank transfer fees can be up to 5% in hidden fees, and Wise is touted to be 8x cheaper than banks.

How to open a Wise account for international transfers

Here’s how simple it is to set up a Wise Borderless Account:

- Go to the Wise.com website. You can also download the mobile app from the Google Play Store or iStore for iOS for full money transferring functionality.

- Click on Register.

- Enter your email address, create a password, and select your country of residence.

- Verify your identity using a government-issued ID. (This is to comply with requirements imposed by the Financial Conduct Authority (FCA) in the United Kingdom, Financial Crimes Enforcement Network in the US and other global authorities.)

You’ll need to add money to your Wise Borderless Account using your bank account, Apple Pay, credit card or debit card. Wise accepts Mastercard, VISA, and certain Maestro cards.

You can then start transferring money from this account or get paid using your Wise account.

How to transfer money with Wise (Formerly TransferWise)

Once you’ve signed up, here’s how to do a money transfer with your Wise account:

- On the website, go to Home and select Send Money. If you’re using the app, tap Send.

- Type in the amount you’d like to transfer.

- Indicate the type of transfer, for example, personal transfer or business transfer.

- Fill in your personal information.

- Fill in the account details and account number of the recipient.

(You can either fill in their bank details or email address. If they have a Wise account, the money will be transferred into it. If they don’t have a Wise account linked to the email you provide, Wise will send them an email requesting their banking details).

- Review the transfer details and add an optional reference for the recipient.

- Choose your transfer type and payment preference. Wise will let you know the fees for each option and approximately how long the money will take to arrive.

Wise will send you an email confirmation or notification on the mobile app. They will also inform the recipient that the money is on the way.

How does someone receive money from Wise (Formerly TransferWise)

To receive money from Wise, you have to have a local bank account, and you must be willing to accept payment in a local currency. With Wise, you will always be sending the money in your country’s currency, and the recipient will receive the payment in their currency.

For example, say you’re doing a wire transfer from the United States in USD to a recipient in Australia. Although you make the payment from your US-based account in USD, the recipient will receive the money in their Australian account, in their local currency only- AUD.

This works the same for each country on the list where the money is being received.

Remember, Wise is a money transfer and currency conversion company.

Using Wise (Formerly TransferWise) for business payments

You can also make a Wise money transfer for your business.

You’ll first need to set up a business profile with Wise. They will ask you for some basic profile information. Then, you’ll go through a verification process to make sure you are who you say you are.

Once your business profile is set up, you can start transferring money. Just remember if you set up your transfer as a business payment, it must come from your business account.

Multi currency account and Wise debit card

Wise also offers a low fee Multi Currency Account, which replaces the TransferWise Borderless Account, and a Wise Business Account.

Both accounts work as a multiple currency, borderless account, letting you hold, send, receive, and spend money as you would with traditional financial institutions.

For international transactions using the multi currency bank account, Wise charges a fixed fee, and a conversion fee when you send to a different currency.

With this borderless account, you can also request a Wise debit card. The debit card lets you spend money anywhere globally using the real exchange rate (mid market exchange rate). So you’ll pay no additional hidden fee.

Next, we’ll answer a few FAQs about Wise.

Frequently asked questions about Wise (Formerly Transferwise)

You may still have some reservations about using this money transfer company. To help you out, we’ve answered the most important FAQs about Wise.

1. What are Wise’ hidden fees?

Many banks and other money transfer services will often hide a fee in their currency exchange fee rate. These fees can vary anywhere from 0.3% up to 20%, depending on the service you select.

Most banks and transfer services will charge a hidden fee when you are sending money internationally and some companies bank on the fact that you won’t check the currency rates or look into the fee. Many banks and wire transfer companies aren’t transparent about charging the fee, so it’s a hidden fee.

For example, on XE.com, the current exchange rate of 1 USD to a Euro is 0.933225, but on Travelex, the exchange rate is listed as 1 USD to a Euro is 0.84. The discrepancy is a hidden fee.

With Wise, you get the mid-market exchange rate, low costs, and a transparent fee structure.

2. What currencies can you send and receive through Wise (Formerly TransferWise)?

When working with Wise, it’s important to know what different currencies you can send and receive.

Wise can send and receive the following currencies and corresponding countries:

- AED — Emirati Dirham — Within the UAE.

- AUD — Australian Dollar — Within Australia.

- BGN — Bulgarian Lev — Within Bulgaria.

- BRL — Brazilian Real — Within Brazil – Wise can only send payments to or from private individuals within Brazil, not businesses.

- CAD — Canadian Dollar — Within Canada.

- CHF — Swiss Franc — Within Switzerland and Liechtenstein.

- CZK — Czech Koruna — Within the Czech Republic.

- DKK — Danish Krone — Within Denmark.

- EUR — Euro — Wise can send out Euros to SEPA-compliant bank accounts and bank accounts denominated in EUR with an IBAN outside of SEPA. Wise can also receive Euros through SWIFT from outside the SEPA zone.

- GBP — British Pounds — Wise can also send out GBP to bank accounts denominated in GBP with an IBAN.

- HKD — Hong Kong Dollar — Within Hong Kong.

- HRK — Croatian Kuna — Within Croatia.

- HUF — Hungarian Forint — Within Hungary.

- IDR — Indonesian Rupiah — Within Indonesia.

- INR — Indian Rupee — Wise sends out INR via RTGS, NEFT, and TPT (as appropriate) to INR-denominated accounts in India. Wise can only receive INR from Indian residents.

- JPY — Japanese Yen — Within Japan.

- MYR — Malaysian Ringgit — Within Malaysia.

- NOK — Norwegian Krone — Within Norway.

- NZD — New Zealand Dollar — Within New Zealand.

- PLN — Polish Złoty — Within Poland.

- RON — Romanian Leu — Within Romania.

- TRY — Turkish Lira (Wise can receive TRY locally from within Turkey and internationally through SWIFT. Wise can only send TRY to bank accounts located in Turkey, denominated in TRY.)

- SEK — Swedish Krona — Within Sweden.

- SGD — Singapore Dollar — Send SGD within Singapore.

- USD — US Dollar — Wise can receive US Dollars via ACH bank debit, domestic wire, and international SWIFT payment.

You can only send money to these currencies (via local transfer)

- ARS — Argentine Peso — Within Argentina.

- BDT — Bangladeshi Taka — Within Bangladesh.

- BWP — Botswana Pula — Within Botswana.

- CLP — Chilean Peso — Within Chile.

- CNY — Chinese Yuan — Within China, from a limited list of different countries.

- COP — Colombian Peso — Within Colombia. Wise can only send COP to Bancolombia recipients within Colombia. Currently Wise is unable to send business payments to COP.

- CRC — Costa Rica Colón — Within Costa Rica.

- EGP — Egyptian Pound — Within Egypt.

- FJD — Fijian Dollar — Within Fiji.

- GEL — Georgian Lari — Within Georgia.

- GHS — Ghana Cedi — Within Ghana.

- ILS — Israeli Shekels — Within Israel.

- KES — Kenyan Shillings — Within Kenya.

- KRW — South Korean Won — Within South Korea.

- LKR — Sri Lankan Rupee — Within Sri Lanka.

- MAD — Moroccan Dirham — Within Morocco.

- MXN — Mexican Peso — Within Mexico.

- NPR — Nepalese Rupee — Within Nepal.

- PHP — Philippine Peso — Within the Philippines.

- PKR — Pakistani Rupee — Wise can send payments to private recipients within Pakistan. Currently Wise is unable to send business payments to PKR.

- THB — Thai Baht — Within Thailand.

- UAH — Ukrainian Hryvnia — Within Ukraine.

- UGX — Ugandan Shilling — Within Uganda.

- UYU — Uruguayan Pesos — Within Uruguay.

- VND — Vietnamese Dong — Within Vietnam. Wise can send payments to private recipients within Vietnam. Currently Wise is unable to send business payments to VND.

- ZAR — South African Rand — Within South Africa. Wise sends out ZAR via SWIFT international payment (in South Africa only) and local transfers.

- ZMW — Zambian Kwacha — Within Zambia.

3. What methods can you use to send money?

Wise recognizes there are several ways people and businesses move money. As such, they provide various ways to transfer money.

Bank Transfers are very common, and they include the following different types of bank accounts:

Bank Transfers

- SOFORT.

- iDEAL.

- Trustly Instant Bank Payment.

- SEPA Direct Debit.

- SWIFT.

Other Payment Methods Wise Accepts Include:

- Credit card (MasterCard, Visa, and some Maestro cards).

- Apple Pay.

- Android Pay.

Keep in mind, when doing a Wise money transfer that not all countries and currencies are compatible with all types of payment forms. As such, it’s your job to quickly review which form of payment works best for the country you reside in and for the country you plan on sending money to.

4. How much do international money transfers cost?

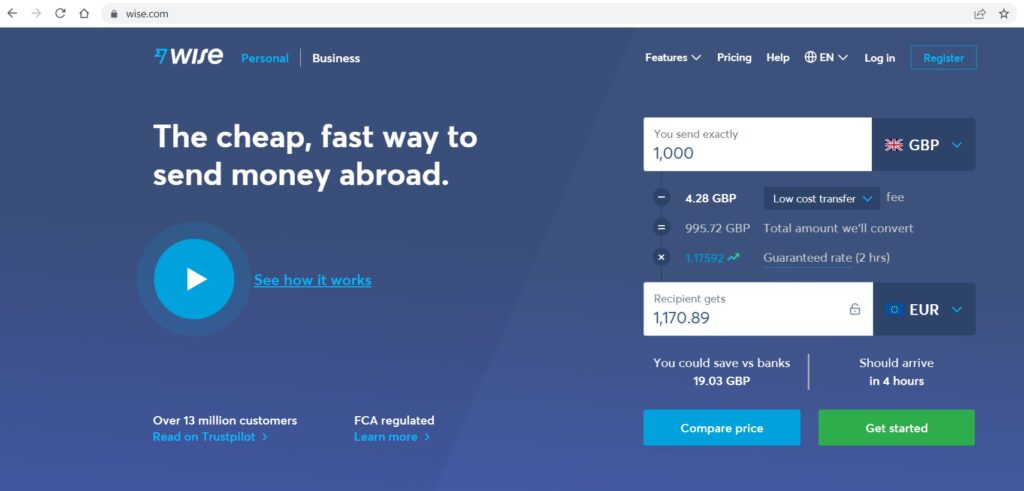

The amount of money you will pay for each Wise money transfer will vary depending on how much you are sending and where you are sending the money. The reason it is always different is because the price for service is based on a percentage of the wire transfer fee. To make this clearer, let’s go through a few examples.

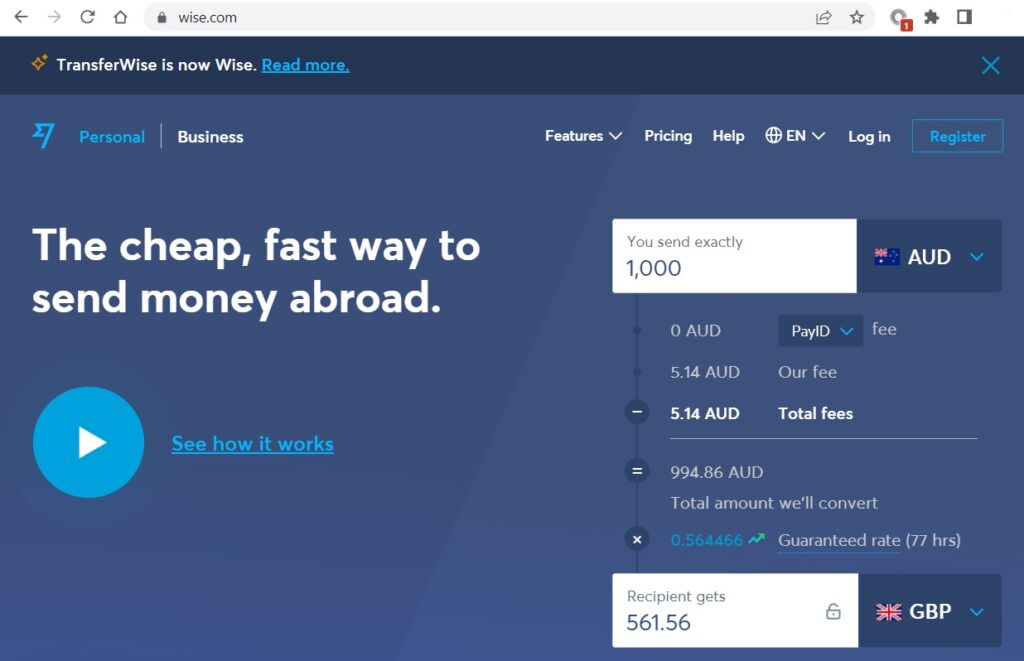

Example 1: AUD to GBP

Let’s say you are in Australia and sending money to the United Kingdom. If you’re transferring 1,000 AUD, the wire transfer fee is 0.7% of the amount that is converted, so 5.14 AUD. Then, the amount that is converted to GBP depends on the mid-range exchange rate, which is currently 0.564466, so that comes to 994.86 AUD. This means the person in the UK will get 561.56 GBP, which includes exchange rates and service fees.

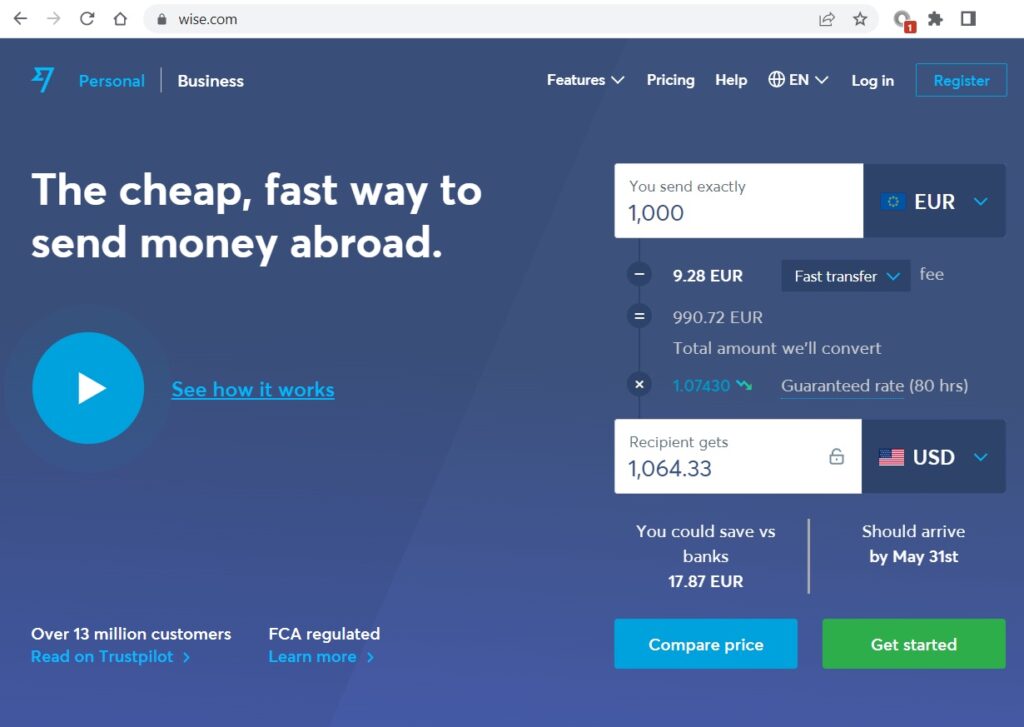

Example 2: EUR to USD

Now, let’s say you are sending money to the United States. For 1,000 Euros, the wire transfer fee for this transaction would be 0.5% of the amount of money that is converted or 9.28 Euros. The mid market exchange rate is currently 1.07430, so that comes to 990.72 Euros. This means the person in the United States will receive 1,061.33 USD.

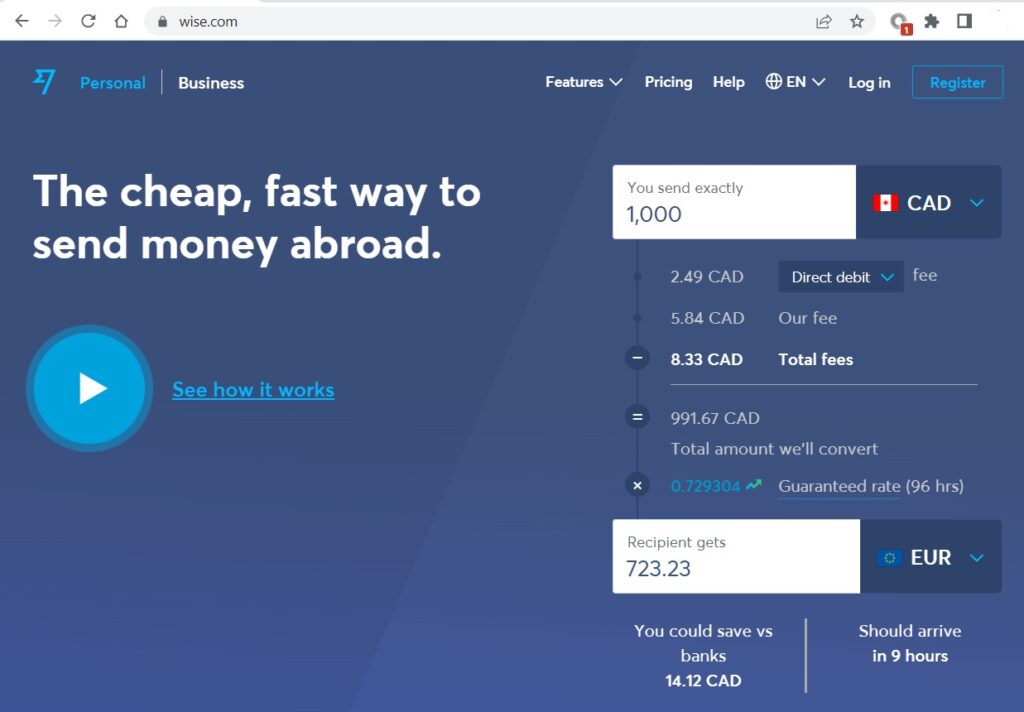

Example 3: CAD to EUR

Finally, let’s say you want to transfer 1,000 CAD to Europe. The wire transfer fee for this transaction is 1% of the amount that is converted, or 8.33 CAD. The current mid market rate is 0.729304 or 991.67 CAD. Therefore, the recipient gets 723.23 EUR.

5. What are the exchange rates they use?

Wise uses with real exchange rates for international money transfers. It’s also called the mid market rate, interbank rate, and spot rate.

The important thing is not what it’s called but what it is. The real exchange rate or mid market rate is the midpoint between the buy and sell rates on the different currency markets, which are always changing. It is the fairest rate and the rate you will find on Google, Yahoo, and Reuters. And there’s no hidden fee added.

For some currencies, Wise offers a guaranteed rate, so you can make the wire transfer at the rates you planned on. These rates only work within a specific period.

6. How long does it take for an international transfer to arrive?

Wise works hard to move money as quickly as possible, but when you actually receive your money depends on a variety of different factors. This means there is no one standard guaranteed delivery date.

The delivery date depends on:

- The countries you are sending to and from.

- Your payment method.

- What time you pay for your transfer.

- Security checks.

To get a better idea of how long it will take, visit the supported currency page and click on the currency in question.

For example, consider the CHF (Swiss Franc) and the RUB (Russian Ruble). It takes one working day to deliver money to a Swiss bank account and three business days to deliver money to a Russian bank account.

Now, our Wise review will cover some of the advantages and disadvantages of using Wise.

Pros and cons of using Wise (Formerly TransferWise)

Wise certainly has some things that set it apart from its competitors but it also has a few downsides that you should be aware of.

Pros

These are the benefits of using Wise.

1. Transparent and low fee structure

TransferWise fee structures are low compared to bank fees and other service providers. Wise fees are also much more transparent.

In fact, TransferWise work to be as transparent as possible. There’s no hidden fee bundled into the currency exchange rate, the price you see is the price you pay.

2. Exchange rate locking

Wise offers a guaranteed rate when you complete an international transfer request. Once you complete the transfer, the exchange rate is locked for a specific period.

So even if the exchange rate fluctuates, you will pay the rate specified for when you did the transfer – as long as you send the money to Wise right away, so they receive it before the time limit runs out.

3. Batch payment tool

Wise has a convenient and free batch payment tool for businesses that need to make a large number of payouts to their customers, freelancers, employees, investors, or suppliers around the world.

With this money transfer company, you can send multiple payments at once by uploading a file. You can then make a single transfer to Wise to cover all payments in the batch.

Cons

Here are the most significant drawbacks of using Wise.

1. No cash withdrawals or deposits

Wise has no physical branch network like banks and some other international money transfer providers do so you can’t make cash withdrawals.

This means that you can’t deposit or withdraw cash like you would with a local bank account. You can only transfer money via your bank account, debit card, credit card, Apple Pay or Google Pay.

2. Limited international reach

With Wise, you can hold and convert money in 53 currencies and send money to 80 countries, whereas other providers such as Ria Money Transfer can send money to 165 countries.

Moreover, their international customer service is also limited, especially if you prefer to speak to a customer support agent over the phone. Their customer service team also warns of high waiting times when calling, which can be frustrating.

3. Doesn’t support cryptocurrency trading or transfers

You can’t do a Wise money transfer to merchants involved in the exchange or trading of:

- Cryptocurrencies.

- CFDs (Contract For Difference).

- Options (including but not limited to binary options).

For example, you can’t make a Bitcoin transfer but you can make transfers to brokerage accounts using standard currencies.

Read on to see how Wise compares to other money transfer services.

Wise (Formerly TransferWise) competitor analysis

If this TransferWise review hasn’t officially sold you on Wise, don’t worry. There are plenty of other wire transfer companies that work as good alternatives, including Ria Money Transfer, OFX, Western Union, Payoneer, PayPal, MoneyGram, Xoom, WorldRemit, CurrencyFair, Paysera, Skrill, and Travelex.

There are also traditional banks, but bank fees are notoriously high.

Some transfer providers charge a fixed fee for currency exchange with the money transfer service, while others have a much more complicated markup system.

Here are some details on the conversion fees and benefits:

| Alternative | Hidden Conversion Fee | Benefits Compared with Wise |

| Ria Money Transfer | 0.3-1% | Recipients can get the money in cash. However, this is mostly for sending from the U.S. |

| OFX | USD 10.71 (for transfers under USD 7139.45) | Transfers aboveUSD 7139.45 are free. |

| Western Union | USD 3.75- USD 127.52 | Can pay via credit card and receive the transfer in cash. |

| Payoneer | 0.5% | |

| PayPal | 3.5-4% | Convenient |

| MoneyGram | USD 1.99 | Recipients can get the money in cash. |

| Banks | 1-5% | |

| Xoom | USD 2.99 | |

| World Remit | USD 2.99 | |

| Currency Fair | Average USD 3.16 (Differs for each country) | |

| Paysera | USD 0-0.11(Additional fees apply for Business transfers) | |

| Skrill | 0-4.99% | |

| Travelex | USD 0-5 |

Final thoughts

As this Wise review demonstrates, there are several alternatives. But Wise fees are low and the fact that they have no hidden transfer fees is outstanding. It’s also great that they can provide a Wise debit card for your day to day transactions as well as a borderless account.

In short, if you’re looking for a comprehensive money transfer company, Wise is a good way to go. They offer service to several countries and currencies. A Wise money transfer also has no hidden fees or markups, and you’ll pay reasonable, transparent fees. Not to mention, the fact that they work off the mid market rate is fair and may save you money on currency conversion in the long run.

Visit Wise.com for more information.